Financial Consolidations process:

3 steps to perform consolidation in Microsoft Dynamics Ax 2009.

- Consolidation company setup

- Subsidiary company setup

- Perform consolidation

I) Consolidation company setup:

Consolidation company creation: Consolidation designated company will not be available for any operational process except having consolidation entries posted in here.

Path: Dynamics Ax > Administration > Common Forms > Company accounts

General Ledger Parameters setup:

Path: Dynamics Ax > General Ledger > Setup > Parameters > Ledger tab

Set value "Consolidated company accounts ' = True

System account:

Path: Dynamics Ax > General Ledger > Setup > Posting > System accounts

Balance account for consolidation differences

Profit & loss account for consolidation differences.

Currency and Exchange Rates:

Path: Dynamics Ax > General Ledger > Setup > Exchange rates > Consolidate tab

The Exchange rates form displays an additional tab, Consolidate, when you select the consolidated company accounts field in the General ledger Parameters form. Closing rate field is used for balance sheet accounts and the value in the Average rate field is used for profit and loss accounts. Add exchange rates for each currency and specify 'Closing rate' & 'Average rate' for all currencies in this form (Overview tab will display all currencies, specify exchange rates & select each one of them and click Consolidate tab and consolidation rates).

Chart of Accounts:

Path: Dynamics Ax > General Ledger > Common Forms > Chart of accounts details

Closing (or) Average: Use Closing or Average options for utilizing rates specified in 'Consolidate tab' of the exchange rates form.

Historical : Use Historical to utilize exchange rates specified in the setup.

This process completes consolidation company setup for consolidations in Dynamics Ax 2009.

II) Subsidiary Company:

The subsidiary setup depends on chart of accounts setup, so following are possible alternative options.

Chart of Accounts Option 1: Identical Chart of Accounts

When this is the situation, the Consolidation account field is selected in the Consolidate Online form during the consolidation process to transfer the balances to the correct accounts.

Chart of Accounts Option 2: No Consolidated Chart of Accounts

In this scenario consolidated company does not have chart of accounts, here two alternatives to perform consolidation.

- Enter a manual mapping on the Chart of Accounts in the subsidiary. This causes the mapped accounts to create automatically.

- Do not enter any mapping. This causes the Chart of Accounts to be created in the consolidated company when data transfers from the subsidiary.

Note: This method is not appropriate for consolidation of a foreign currency subsidiary because conversion principles cannot be applied.

Chart of Accounts Option 3: Different Chart of Accounts

Having different chart of accounts in subsidiary & consolidated companies must be mapped to the consolidated company.

Map Chart of Accounts: (This process should be done for all subsidiary companies)

Path: Dynamics Ax > General Ledger > Common Forms > Chart of account details

Map Dimensions: (This process should be done for all subsidiary companies chart of accounts)

Path: Dynamics Ax > General Ledger > Common Forms > Dimensions

This completes subsidiary company setup and Consolidations.

III) Perform a Consolidation:

Options to perform consolidation:

- From the same database using the online option

- From and, or to another database using the Import/Export option

Before you perform a consolidation at the close of a period, ensure that the period closing preparatory activities are performed, but do not close the subsidiary accounts until the consolidation is completed.

Consolidation, Online:

Path: Dynamics Ax > General Ledger > Periodic > Consolidate > Consolidation, Online

Dimension tab: Gives option to select none, dimension, group dimension, company accounts and account. Select 'Group dimension' to rollup dimension transactions to consolidation company dimension values (Group dimensions must be specified for all dimension values in all subsidiary companies for this option)

Companies tab:

Share: Indicate the percentage of the selected company accounts to be included in the consolidation. This is used if the consolidated company owns part of the subsidiary.

Note: Share field is not available or relevant on the consolidation, Export form

For the selected subsidiary company account - if the subsidiary company currency differs from that of the consolidated company - select the type of account that consolidation differences are posted to:

- Profit & loss – Differences are posted to the consolidated company ledger account that is indicated for the Profit & loss account for consolidate Financial Consolidations - Dynamics Ax 2009 (Part 1)on differences value in the Posting type field on the System accounts form of the consolidated company.

- Balance – Differences are posted to the consolidated company ledger account that is indicated for the Balance account for consolidation differences value in the Posting type field on the System accounts form of the consolidated company.

- You must make an appropriate selection according to the accounting practice of the country/region of the consolidated company.

Eliminations tab:

Note: Elimination rules can be applied here.

Click button 'OK'

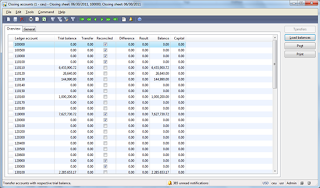

Then validate balances through General Ledger > Common Forms> Chart of account details (Select respective account and validate the balance of CEC & CEU companies, notice the balance in consolidation company).

Then validate balances through General Ledger > Common Forms> Chart of account details (Select respective account and validate the balance of CEC & CEU companies, notice the balance in consolidation company).

To eliminate internal transaction. You have to set up the elimination rules.

General ledger > Setup > Posting > Ledger elimination rule

When you run consolidate

General ledger > Periodic > Consolidate > Consolidation, Online.

You have to select the elimination rule in tab Elimination ( should be Proposal post instead of Posting).

After running that proccess The system will automatically generate the elimination transacion . You can inquiry and check it before posting.